The A to Z about the Mortgage payment calculator Montreal

Applying for a home loan means that you need to know if you can afford it. There are many different ways how you can find out if you will be able to afford the loan.

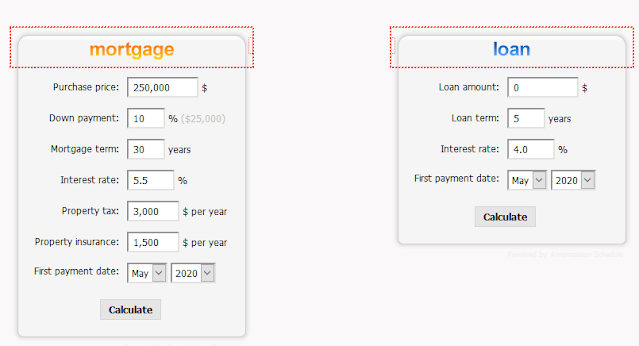

One of the most popular and accurate methods is using the mortgage payment calculator Montreal. These calculators will give you an idea about the premiums you are going to pay each month. Now you can see if you will be able to afford the repayments, or if you should look for a cheaper mortgage loan. We are giving you everything you need to know about these payment calculators to make sure that you choose the right one.

What is a Mortgage payment calculator?

You might not have heard about the payment calculator before, and you don’t know what this is and how you can use it to see if you can afford a mortgage loan. Even if you are getting the lowest mortgage rates in Quebec, you still need to see if you can afford the monthly premiums.

This is what the calculator does. It gives you an idea of the monthly premiums you are going to pay for the next 10 to 20 years. But, it is important to know that you need to use the right calculator, otherwise you will get the wrong estimate.

Pros and cons of using a payment calculator

If you are using the right payment calculator you will be able to enjoy a couple of pros and benefits. You will know the estimate on your monthly repayments, and you will not need to waste your time and the mortgage broker’s Montreal time by applying for something that you can’t afford. The calculator makes it easier to sit at home and see what amount your mortgage loan can be.

The cons and problems with the payment calculator are when you are using the wrong one, or if you are using it incorrectly. This means that you will not get the right estimate, and you might think that you can’t afford a premium when you actually could have afforded it.

Things to consider when choosing your calculator

It is important to know what to look for when you are choosing the calculator to calculate mortgage payments Montreal. As you already know that if you are using the wrong one, you will not get accurate readings. So, you need to consider these before you use just any calculator.

Make sure that the calculator offers interest rate options. Sometimes your interest rate might be different from the next person’s. So, adding the amount of interest will give you a more accurate reading.

Completely customizable. You need to be able to add or remove any additional amounts that need to be included in your monthly premiums. Like your down payment.

The calculator needs to be recommended by the best mortgage brokers and lenders on the market. If they are recommended, you will have a better chance of accurate readings.

How to use a calculator to get accurate results?

There are a couple of things that you need to know in using a calculator correctly. Firstly, you need to make sure that you are getting the right amounts. From the interest rate percentage to your down payment and other fees that might be added. The moment that you aren’t giving one right amount, the premium estimate will be incorrect and you will not know the right premium amount.

The next thing that you need to consider is to talk to a mortgage broker Montreal before you use any calculator. They might be able to assist you in finding the right calculator that will give accurate readings. It is important to know that you will only get the estimate from the amounts you add.

There are many reasons why you want to make use of a calculator to calculate mortgage payments Montreal. But, if you don’t get the right calculator, you will not get an accurate estimate. With our A to Z guide about these calculators, you will know for sure what your monthly premium will be, even if you didn’t visit a broker. This is something to consider so that you know what you can afford and what not.

.jpg)

Comments

Post a Comment