Your resource for Canadian mortgage calculations that are accurate

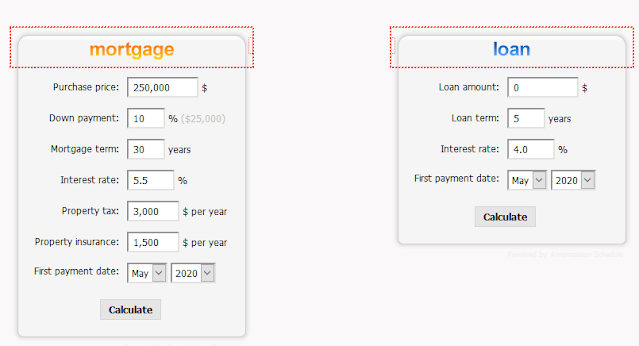

The mortgage calculator offers estimates for the necessary monthly payment as well as other associated expenses. There are options for adding extra payments or yearly percentage increases of usual mortgage-related expenses. Canadians are the target audience for the calculator.

A mortgage is a loan that is often secured by real estate. Lenders define it as credit obtained to buy real estate. In essence, the buyer agrees to pay back the borrowed funds over a predetermined period—in North America, this is often 15 or 30 years while the lender helps the buyer pay the home seller. Each month, the buyer gives the lender a payment.

Your go-to source for precise Canadian mortgage calculations

The mortgage calculator provides an estimate for both the required monthly payment and other related costs. There are alternatives for increasing yearly percentages of regular mortgage-related expenses or making additional payments. The calculator's intended audience is Canadians.

A mortgage is a loan that is generally secured by real estate.

It is defined by lenders as credit secured for real estate purchases. In essence, the buyer consents to repay the borrowed money over a defined period (in North America, this is frequently 15 or 30 years), while the lender assists the buyer in paying the home seller. The buyer pays the lender a payment each month.

In the "Down payment" column, enter the amount of your down payment (if you're buying) or equity (if you're refinancing). The value of a home less any outstanding debt equals the home's equity. When you purchase a home, you must pay a down payment in cash. You can enter a fixed amount of money or a percentage of the purchase price.

The majority of your mortgage payment each month is made up of principal and interest. What you pay the lender for the amount you borrowed is the sum of the principal and interest. Additionally, your lender may withdraw additional funds from your account each month for escrow. Normal payment to your insurance company and the local assessor would subsequently be made by the lender (or servicer).

Homeowners' insurance

Your insurance coverage covers financial losses and property damage from hazards including fire, storms, theft, falling trees on houses, and other risks. If you live in a flood zone, you'll have a second insurance policy, and if you reside in an area that is vulnerable to earthquakes or hurricanes, you may have a third. Similar to property taxes, your monthly insurance payment is one-twelfth of the annual premium, and your lender or servicer will pay the balance when it is due.

Mortgage Insurance

If your down payment is less than 20% of the home's purchase price, mortgage insurance, which is also added to your monthly payment, is probably in play.

Since it is likely to be your largest ongoing expense, knowing your monthly house payment is crucial when you design your housing budget. As you search for a buyer loan or a refinance, you may estimate your monthly mortgage payment using Bankrate's mortgage calculator. To evaluate several possibilities, simply change the information you enter into the calculator. You may select using the calculator:

If you have a defined budget, a 30-year fixed-rate mortgage is typically the best choice. These loans have lower monthly payments even though you'll pay more interest overall. If your budget allows it, a 15-year fixed-rate mortgage reduces the overall interest you'll pay.

As interest rates climb, it might be tempting to choose an adjustable-rate mortgage (ARM). Compared to their conventional equivalents, ARMs frequently have lower introductory rates. A 5/6 ARM, which offers a fixed mortgage rate for five years before modifying every six months, maybe the ideal choice if you only plan to remain in your home for a short period. However, keep in mind that after the introductory rate expires, your monthly mortgage payment may change significantly.

Landmark Realities, one of Canada's biggest commercial mortgage lenders, is a market leader in offering real estate financing options for properties primarily in the industrial, retail, office, and apartment building sectors. We have strong relationships with local, regional, and national real estate owners in all of Canada's key mortgage markets because of our regional branch system.

.jpg)

Comments

Post a Comment