How to find the best mortgage broker west island?

If you are looking for a trustworthy mortgage broker in your area and the best mortgage rates Quebec, there are a number of methods you can do it.

It is the job of the mortgage broker to act as a liaison between borrowers and lenders. Most real estate agents also broker mortgages for potential homebuyers, which is a lucrative sideline for them. Mortgage brokers are real estate agents that specialize in connecting borrowers with banks and other financial institutions that can lend them money. Because of this, the broker-lender relationship can be mutually beneficial.

Who is the ideal mortgage broker for you?

Several methods exist for finding a reliable mortgage broker in your neighborhood.

1. See if anyone you know has just purchased a property and ask them for a recommendation. If a friend or family member recommends you to someone, you're more likely to believe them. Even if they don't specialize in mortgage lending, other real estate brokers can be a good source of referrals. With an established broker, you have access to a wider range of lenders, allowing you to choose from a wider range of loan possibilities. In the end, you'll get a better offer as a result of this.

2. Look up local real estate agency broker profiles on the Internet. Customer reviews can be an excellent source of recommendations. Working with a local mortgage broker has the added benefit of putting you in touch with lenders and appraisers who are already familiar with the area. Viewing broker profiles online can help you locate a broker that provides the services you require.

3. Attend a number of community open houses to get to know local real estate agents. Meeting real estate experts in a more relaxed setting is one of the primary benefits of hosting an open house. Request a business card from the broker. Make the most of this chance to get to know the person better by striking up a conversation. Investing the time now could pay off in the future.

4. Check out the classified advertisements in your local newspaper for real estate. In addition to promoting the real estate industry as a whole, ads are frequently used to promote specific agents and brokers. Marketing properties, agents, and brokerage services all in one ad are possible with well-planned copywriting.

5. Ask for numerous references, ideally from local bankers and prior clients, and then follow up by verifying them. A seasoned broker will be more than happy to provide references to new clients. Find out if the broker is a member of any professional or trade organizations, such as the Better Business Bureau.

Mortgage brokers vs banks: Which is better for you?

If you have a complicated financial position, such as a history of weak credit or a 'non-standard' salary, you should use a mortgage broker. In these types of situations, a specialized mortgage lender is often required, and you'll need the assistance of a broker to locate one.

Going directly to the bank is only recommended for financial experts who are confident that their bank is delivering the greatest possible mortgage deal, and if they can prove it. Otherwise, you'll be restricted to a single product line.

Why do you need a broker?

People choose mortgage brokers rather than banks, building societies, or other lenders for a variety of reasons, including:-

Access to a greater selection of items can be gained through brokers.

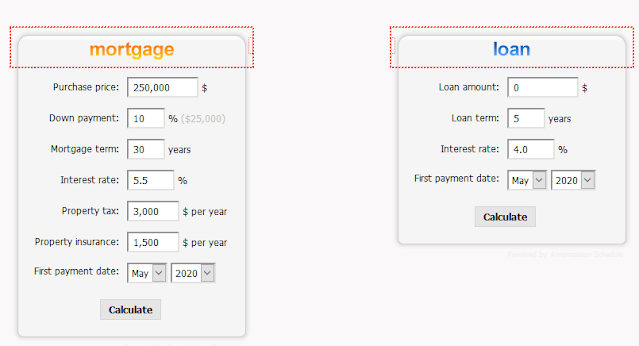

They can assist you to improve your credit rating and preparing for a mortgage application with the help of Mortgage payment calculator Montreal.

Make your life easier by doing your buying and bargaining for you.

Make sure your mortgage contract is complemented by the correct insurance.

We can assist you with all of your documentation requirements.

They are able to provide personalized guidance and specialized knowledge.

To secure a mortgage, even if you have terrible credit or are seeking a mortgage for self-employed people, they can help.

The appropriate broker can help you prevent unwanted marks on your credit report by ensuring that you get the right mortgage lender, the first time.

.jpg)

Comments

Post a Comment