Complete guide to Mortgage brokers Quebec

Before you can buy any property, you need to get an approved mortgage loan. And, this can be really hard to do, if you don’t know all the rules and regulations about mortgages and how to apply for them.

This is why most people make use of mortgage brokers in Quebec. This is to make sure that you have the best possible chance of getting an approved loan. These are some essential information about these brokers and how you can use them to get an approved mortgage loan.

Mortgage broker explained

First things first. What is a mortgage broker and why is this something that you need to consider using? A mortgage broker is someone that assists you in applying for a home loan or mortgage loan. They are doing everything for you so that you can start looking at available homes without any problems.

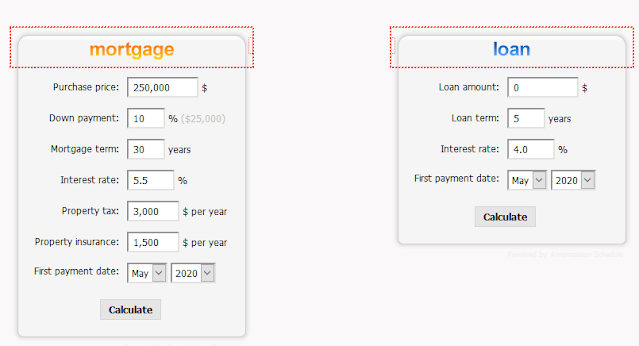

They have the experience and knowledge to apply for as many loans as possible, getting you the best deal in town. They will also assist you in getting and using the best Mortgage calculator Montreal.

Reasons why you should make use of a broker

Why should you make use of these brokers? The truth is that there are so many reasons why you should make use of the brokers. Not only will they assist you in finding the best Mortgage interest rates in Quebec, but they will also make sure that you get a loan approved.

Another reason is that they know more lenders than you do. Private as well as bank lenders. So, they have a much better chance of finding an approved loan than you. They also work with these people on a regular basis. And, this can let the lenders decreasing the interest rate so that you can pay a lower premium each month. You don’t need to go from office to office to apply for a mortgage loan. The broker is doing everything for you.

What will happen when you don’t use a mortgage broker?

What will happen when you are applying for a loan yourself, and not making use of a mortgage broker in Quebec? Firstly, it is going to take forever to apply for a home loan. With each lender, you need to fill in an application form and make sure that you have all the right paperwork with you. Then, the wait to hear if you are approved is also taking a long time.

When you are approved, you will not have a say in the amount of interest that they are asking you. You will not even know if the interest is market-related or not. And, you even might pay a down payment before they are approving your application. Not everyone has a down payment to give when buying a home.

Things to consider when choosing your mortgage broker

There are a couple of things that you should consider when you are choosing your mortgage broker. There are different brokers, and you should use the best one possible.

The first thing that you should look for is a broker that is offering the best mortgage calculator Montreal. Making sure that you can calculate if you can afford the loan before you apply for it. You should also make sure that they have the right experience and qualifications to assist you correctly.

Asking around your friends and family to get the best broker is also something to consider. They will know who you can trust and who you can’t trust. They might be already purchased a home and already used a broker. You also would need to consider the fee that they are asking. Some are asking really high prices for a service that wasn’t recommended. The fee should be reasonable and offer some great services.

When you are looking for real estate to purchase, you need to make sure that you are getting assistance for your mortgage loan. There are many things you should consider in order to successfully get your loan. This is why so many people recommend mortgage brokers Quebec. With them, you can’t go wrong and you will get all the assistance to get an approved mortgage loan to buy your home. Your dream home that you can live in for the rest of your lives.

.jpg)

Greetings, I am Benjamin, a loan broker with BLB Brokers & co. Do you have an urgent need for loan options for your private /business purchase or investment purpose? Kindly reply back for best options. Via- blbbrokers@hotmail.com

ReplyDeleteYours sincerely,

Benjamin L. Briel.