Mortgage protection insurance Montreal explained

One thing that first-time buyers don’t realize is that there are so many things about getting a home loan that they don’t know. Things that are actually very important to know.

We are talking about mortgage protection insurance Montreal. You might have heard about this type of insurance, but do you really know everything that there is to know about it? Or, is this the first time that you hear about this insurance? At the end of the day, it doesn’t matter. What matters is that you know what it is and why this is something important to consider.

What is mortgage protection insurance?

First things first. What is this protection insurance? This is insurance that will cover you when you can’t repay your home anymore. If you have lost your income, getting injured or sick and you aren’t able to work for an income anymore.

This is also insurance that ensures that the home is repaid the moment that you die. Meaning that your family will not have the problem of finding the money to repay the home, or even worrying about losing the home altogether. This is a protection cover, to ensure that you just don’t lose your home if you lose your income or can’t work for any medical reasons.

Are you forced to take the insurance?

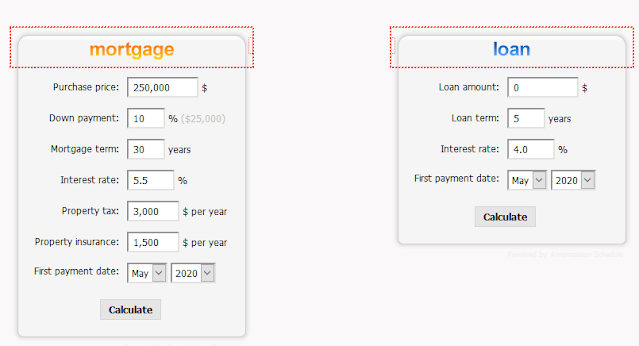

In some countries, you are forced to take protection insurance. And, you need to know that when you are making use of the Mortgage calculator Montreal, this added fee isn’t calculated with your premium. So, you might get a shock when you get your final premium, and it is a lot more than what you thought.

At the end of the day, even if it isn’t something that you need to take with your mortgage, this is still something that you need to consider. You never know what is going to happen in the future, and you don’t want your family to be without a home. This is the one thing that they never need to worry about.

Why is this something that you should consider taking

Many people don’t consider adding mortgage protection insurance Montreal to their mortgage. This is mostly because of the premium increase that they will have. They think that this is unnecessary and that they will not use the insurance at all.

However, one thing that you need to know is that you will never know if you are going to use the insurance or not. And, you don’t want to wait to see. When you have this protection insurance, you are going to have your home, even during tough times. When you have an illness like cancer or even the Coronavirus, you can get some payment relief for a couple of months. The same goes for when you were in an accident and you are disabled. When you die or your spouse dies the mortgage is paid in full. No more worries about a home premium while your grief as well.

The added Corona clause in most insurances

From 2020, most protection insurances added the Coronavirus clause in their policies. This is for those people that have the insurance and that gotten sick during the pandemic. To give them some relief to ensure that they don’t lose their home while they are in the hospital recovering, or even fighting for their lives.

Many people have lost their jobs during the pandemic, and many are still going to lose their jobs during 2021, because of the pandemic, and this added clause gives people hope to get back on their feet, without losing their homes as well.

The protection insurance that you might need to take when you are buying a home, is for your protection. Even if the calculations might not be correct when you use the Mortgage calculator Montreal to get an estimate about your premiums. This is still something that you should use. This is for your reassurance that when something happens to you or your spouse that the one thing you don’t need to worry about is your home. That your home will be covered. No matter if you are sick for a couple of months, lost your job, or if you or your spouse die. This is essential insurance that you should make use of.

.jpg)

Comments

Post a Comment