Everything about mortgage rates Quebec

Purchasing property like homes and offices isn’t easy. There are so many things that you need to think about. Things that you need to make sure about.

One of these things is that you need to apply for a mortgage loan and you need to make sure that you know everything about mortgage rates Quebec. This is the only way that you can be sure that you are going to apply for the right mortgage and that you are going to get the best rates for your loan. These are the things about mortgages that you need to know.

What is a mortgage

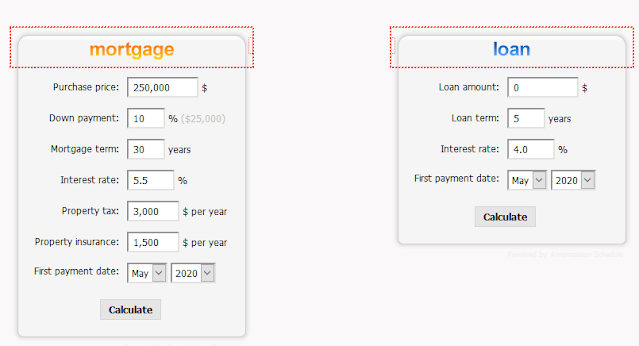

You might have heard about mortgages and mortgage calculator Montreal, but do you really understand this loan? Do you know when you can apply and when you should apply for another type of loan? It is important to make sure that you know what a mortgage is so that you can know when and how you can apply for the loan.

A mortgage is a type of loan that you are getting when you want to purchase the property. This can be any type of property like homes and offices. The loan is paid back over a long period, up to 20 years. Meaning that interests can be high after 20 years.

Why are the mortgage rates differ from one lender to the next?

When you are applying for a mortgage loan, you will see that the rates are different with each lender that you are applying with. The question that many have, is why? Why are the mortgage rates Quebec differ from one lender to the next?

Each lender has the right to decide their own rates, interests, and other fees that are added to the loan. Meaning that you will never get two mortgage loans that will have the same premium. This is also why many are making use of the mortgage calculator Montreal, to ensure that they know what premium they can expect to pay. This is also the reason why it is recommended that you are applying for this loan to more than one lender.

Making sure that you can afford the loan and repayment before you apply for the loan

One thing is for sure. You need to make sure that you can afford the loan and repayment before you can apply for the loan. You can get into serious trouble if you apply and accept the loan, but you can’t repay the loan. Remember that this is a long-term loan that is repaid over the years.

This is why you need to do your homework and make use of mortgage calculators before you decide that you can afford the loan. Don’t apply for the loan, if you see that you can’t afford the repayments. Remember that with a home there are many other financial responsibilities that you need to pay for as well.

Things to consider when you are applying for a mortgage loan

There are really many things that you need to consider when you are applying for a mortgage loan. Knowing the mortgage rates Quebec isn’t just the only thing that you need to know. You should also make sure that the lender is legit, that the contract doesn’t have any small print on, and that you can afford the repayment plan.

You should apply to more than one mortgage loan. Making sure that you are getting the best deal with the best rates and premiums. You won’t get that if you are just applying to one lender.

Using a mortgage broker

This is a great option if you are looking for a mortgage loan. You can make use of a mortgage broker. They are getting paid to find a mortgage loan that you can afford. They are sending in the applications and making sure that you are getting an approved application.

Mortgage loans. Some might have applied to one before, while others never have applied for a mortgage before. This is why you need to make sure that you are getting to know everything there is to know about mortgages, mortgage rates Quebec, and how you can apply for a loan. Then you will know for sure that you are going to an approved loan and a repayment plan that you can afford.

.jpg)

Comments

Post a Comment